HomeQuest Properties, LLC is a multifamily real estate investment firm based in Houston, Texas. Our Principals and Partners have years of experience in the acquisition, operation and disposition of single and multifamily assets. We focus on stabilized, cash flowing and value-add multifamily assets that provide above market returns to our investors. We work with private investors, commercial brokers, top property management companies, attorneys and commercial lenders, in the sourcing, due diligence, funding, operation and disposition of 100+ units multifamily assets, within some of the top US markets.

Read More

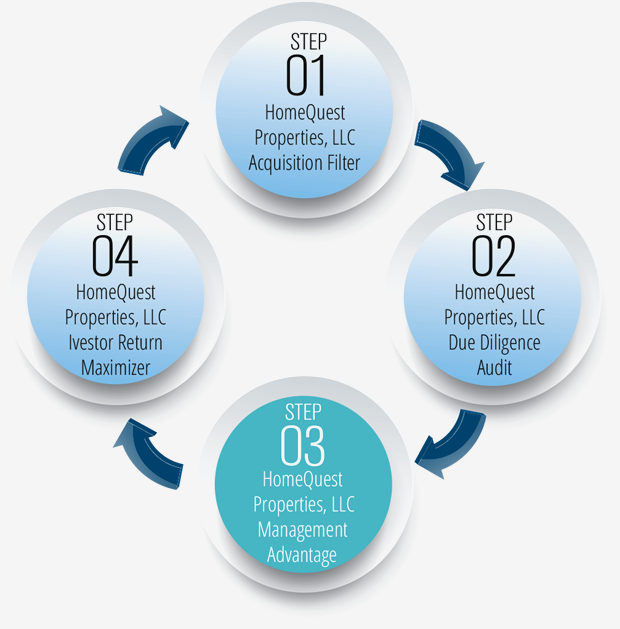

We thoroughly analyze 95% of all deals in our targeted markets with only 2% – 3% qualifying for further review. This strict filtering process ensures that only assets which meet our conservative underwriting criteria, as well as focus on cash flow for investors are selected.

When on-site with our team of experts, we inspect and analyze on site all financials as well as the physical condition of the property, in order to mitigate potential risks and uncover opportunities for our investors. We adjust our financials based on our on-site findings and ensure that the deal still makes sense. Only qualified deals move forward.

Our systematic team approach to performance, KPIs and people constantly elevates our communities to highest standards. This ensures predictable investor cash flow and appreciation.

Utilizes a cash flow centric approach, driving profits to the bottom line, while maintaining and continuing to optimize the asset. This positions the property for a proper and profitable exit for our investors. With return of equity and profits, our investors are now positioned to take advantage of the next HomeQuest Properties, LLC acquisition.

Allows us to thoroughly analyze 95% of all deals in the markets we target with only 2% to 3% qualifying for further review. This strict filtering rocess ensures only assets which meet our conservative underwriting with focus on cash flow for investors get selected.

Our team of experts inspect and analyze on site all financials and the physical condition of the property to mitigate potential risks and uncover opportunities for our investors. Only qualified deals are allowed to move forward.

Our systematic team approach to performance, KPIs and people constantly elevate our communities to top of class. Ensuring predictable investor cash flow and appreciation.

utilizes a cash flow centric approach driving profits to the bottom line while maintaining the asset. This positions the property for a proper and profitable exit for our investors. With return of equity and profits, our investors are now positioned to take advantage of the next HomeQuest Properties, LLC acquisition.

Managing Partner, Acquisitions and Operations

Managing Partner, Investor Relations

Multifamily investors are bullish on the strength of the market, according to the recent findings of the Mid-Year Berkadia Powerhouse Poll, conduct...

Continue Reading

Very good article on what an apartment syndication is, originally published on BiggerPockets.com. Author: Michael Bishop, Austin, TX. Syndicatio...

Continue Reading

One of the many advantages of investing in commercial multifamily properties are the many tax advantages available to both, passive and active inve...

Continue Reading

by Syndication Attorneys PLLC | Dec 20, 2017 Although there ar...

Continue Reading

YouTube video on multifamily fundamentals for predictable passive income. Published by Financial Attunement & BAMF Youtube Channel To view v...

Continue Reading